Thinking To Transfer Out Of Your Kimberly-Clark Defined Benefit Or Defined Contribution Pension Scheme?

Background

The Kimberly-Clark Pension Scheme (KCPS) was incorporated on 4 February 1965 and has supported thousands of UK employees through Defined Benefit (DB) and Defined Contribution (DC) retirement provisions.

- DB Section: Closed to new entrants in 2000, offering guaranteed retirement income based on years of service and final salary.

- DC Section: Introduced in 2000 and closed to new entrants in 2019.

This shift mirrors broader UK trends, where DB schemes have become less common due to their cost and complexity for employers.

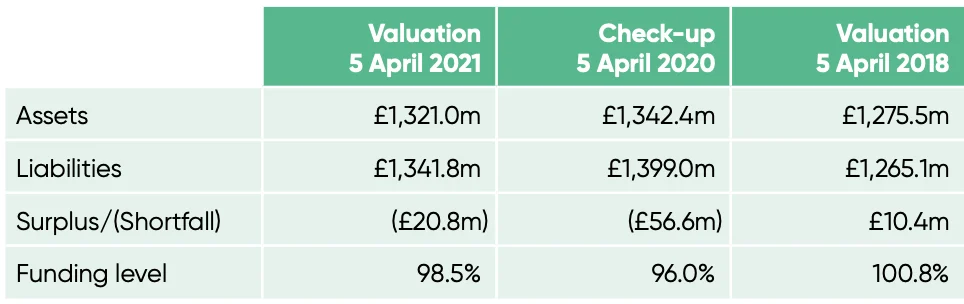

Funding Levels of the Kimberly-Clark Pension Scheme: Managing Stability and Risk

The Kimberly-Clark Pension Scheme has experienced fluctuations in its funding position over recent years, reflecting wider economic challenges and investment performance:

Source: Kimberly-Clark. (2022). Kimberly-Clark Pension Scheme – 2022 Summary Funding Statement. Available at: kc.wordshopweb.co.uk/storage/app/uploads/public/627/8d4/0bd/6278d40bd302d651462409.pdf (Accessed: 14 July 2025).

- 2018: The scheme was in a healthy surplus of £10.4M, fully funded at 100.8%.

- 2020: Likely impacted by market volatility from COVID-19, assets fell while liabilities rose, resulting in a £56.6M shortfall and a funding level of just 96%.

- 2021: Funding recovered to 98.5% as assets increased and liabilities decreased slightly, narrowing the shortfall to £20.8M.

CEO Summary:

“The recovery in 2021 from the 2020 downturn suggests the Trustees are proactively managing risk, possibly rebalancing investments or negotiating increased employer contributions. While still in deficit, the 98.5% funding level is within striking distance of full funding, and significantly healthier than many UK DB schemes. For members, this means the scheme is relatively stable, but continued monitoring is essential. Funding levels can impact transfer values and long-term benefit security.”

— Dominic James Murray, CEO & Founder of Cameron James

What Is a Pension Deficit and Why Does It Matter for KCPS Members?

A pension scheme being in deficit means it currently holds insufficient assets to meet all its future benefit promises to members. In the case of the Kimberly-Clark Defined Benefit Pension Scheme, the funding shortfall suggests that if every member retired today and claimed their full entitlement, the scheme wouldn’t be able to meet 100% of those obligations.

Under UK law, Trustees are required to report funding shortfalls to The Pensions Regulator (TPR) and to implement a Recovery Plan. This plan outlines how the scheme intends to return to full funding, typically through a combination of employer contributions, investment returns, and liability management.

While the existence of a Recovery Plan is reassuring and shows proactive governance, it’s important to note that:

- There is no legal requirement for the plan to succeed within a specific timeframe.

- Schemes face no penalty if the Recovery Plan falls short, they simply have to revise and resubmit it.

For members, this underscores the importance of staying informed. Although the scheme is actively managed and near full funding (98.5% as of the last valuation), a small deficit still introduces potential risk to long-term security, especially in the event of employer insolvency or market downturns.

How Is Your Kimberly-Clark Pension Money Invested?

The scheme’s Defined Benefit assets are currently allocated as follows:

- Growth assets: 18%

- Matching assets: 82%

This allocation reflects a cautious investment approach, prioritising the scheme’s ability to meet liabilities as they fall due (through matching assets), while still seeking some capital growth (through growth assets).

One topic receiving growing attention in the pension world is Liability-Driven Investment (LDI), a strategy designed to reduce volatility by aligning assets with future liabilities. While LDIs offer potential benefits in stabilising funding levels, they’ve also drawn scrutiny after recent market shocks (e.g., 2022 gilt crisis).

🎥 Want to learn more about LDI and how it could impact your pension?

Watch our video on this topic:

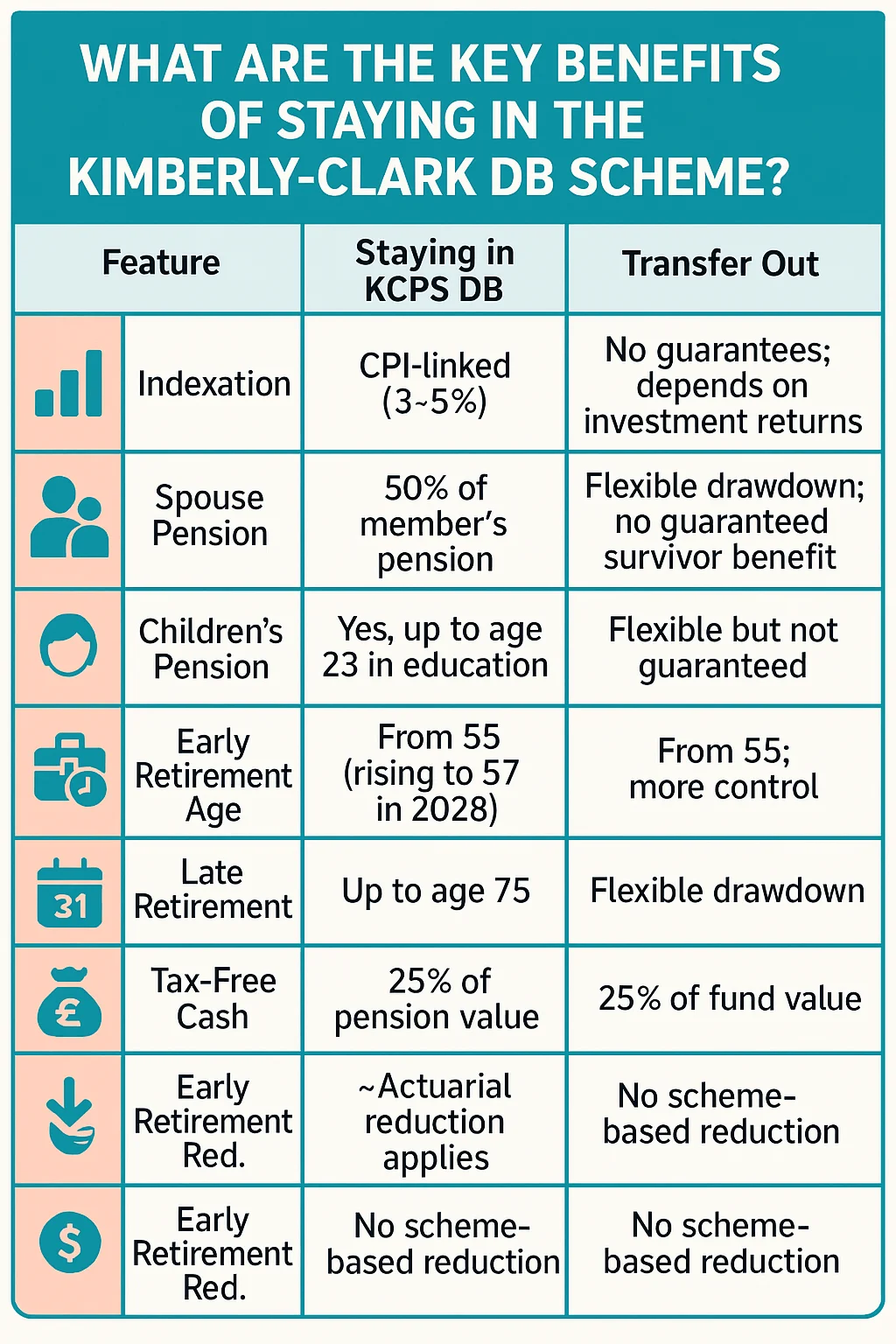

What Are the Key Benefits of Staying in the Kimberly-Clark DB Scheme?

Deciding whether to remain in your Defined Benefit scheme or transfer out requires a clear understanding of the trade-offs. Staying in the Kimberly-Clark DB Scheme offers stable, guaranteed benefits, while transferring out introduces flexibility but also, possibly, investment risk and uncertainty.

The following table provides a side-by-side comparison to help you visualise how the core features differ between the two options:

Interesting Facts About KCPS

Indexation and Inflation Protection

Once your Kimberly-Clark pension begins payment, it receives annual increases linked to the Consumer Prices Index (CPI). These increases vary by the date of pension accrual:

- Pre-April 1997 accrual: Fixed 3% annual increase

- Post-April 1997 accrual: CPI-linked with a minimum of 3% and a maximum of 5%

- GMP (1988–1997): CPI-linked, capped at 3%

- GMP (pre-1988): No annual increase

This inflation protection adds long-term value to the defined benefit income.

Spouse and Children’s Benefits

In the event of the member's death:

- Spouse/Civil Partner: Receives 50% of the member’s early retirement pension and 50% of the pre-commutation pension revalued to the date of death

- Young Spouse Reduction: Applies at 2.5% per year for spouses more than 10 years younger

- Guarantee Period: 5 years

- Specified Dependant: If named in service, treated as legal spouse/civil partner

- Unmarried Members: Contributions refunded if no dependants

- Children’s Pension: Payable to children under 16, or up to 23 in full-time education

Retirement Flexibility

- Early Retirement: Possible from age 55 (57 from 2028), subject to Trustee approval and actuarial reduction

- Late Retirement: Possible up to age 75, with uplift applied

- Tax-Free Cash (PCLS): Up to 25% of the pension may be taken as a lump sum at retirement

Recent Case Study: Transferring Out of Kimberly-Clark

Timelines: What to Expect

- Total process: ~7.06 months

- Scheme processing: Approx. 2–3 months

Transfer Values

- Case CETV: £2.2M

- Outcome: Transferred to SIPP for estate planning and drawdown flexibility

Transfers of this size require careful assessment and strict compliance. The client received formal suitability advice and was able to execute within the CETV expiry window.

Our Transfer Team Verdict on the Kimberly-Clark Defined Benefit Pension Scheme: 8/10

In our experience, the Kimberly-Clark scheme administrators are responsive, efficient, and far easier to work with than many other DB schemes.

- Phone response times average between 5–10 minutes, compared to other schemes where our team can be on hold for up to an hour.

- Email replies typically arrive within 5 working days, which is well above industry average.

For the case referenced earlier, a dedicated administrator was assigned to manage the client's file. This continuity of contact streamlined the entire process, reducing miscommunication and enabling quicker resolutions to queries.

One of the biggest advantages was the clarity and structure of the scheme documentation. When a scheme provides well-organised and complete information, it significantly reduces the need for repeated follow-ups. This in turn enables our team to submit all necessary CETV documentation to the Pension Transfer Specialist promptly, ensuring our clients receive their regulated advice as efficiently as possible.

In short, Kimberly-Clark’s scheme administrators support the transfer process rather than obstruct it, a welcome change in an industry where administrative bottlenecks are often the biggest delay.

Ready to Understand Your Kimberly-Clark Pension Options?

Whether you're considering transferring out or simply want a clearer picture of your Kimberly-Clark Defined Benefit or Defined Contribution pension, speaking with a regulated adviser early can help you avoid delays, understand your entitlements, and make the most informed decision possible.

At Cameron James, we’ve successfully handled multiple transfers from the Kimberly-Clark Pension Scheme. We understand the scheme’s structure, its administrators, and the documentation required to get your case moving efficiently.

FAQ

How Will Cameron James Keep My Kimberly-Clark Pension Transfer on Track?

At Cameron James, your Kimberly-Clark pension transfer is proactively managed by our dedicated Transfer Team, a specialist department focused exclusively on keeping your transfer moving efficiently and without delay.

Once your paperwork is submitted, our team contacts the Kimberly-Clark scheme every 3–5 working days to check on progress and ensure timelines are being met. You’ll also receive bi-weekly updates, so you're never left wondering where things stand.

Our Transfer Team operates Monday to Friday, 8am–5pm, and has direct experience dealing with Kimberly-Clark administrators. They know the scheme’s expected service standards and hold them accountable. If things fall behind or delays occur, our team escalates the matter directly, and when appropriate, will submit a formal complaint to recover compensation for avoidable hold-ups.

Because we’ve worked with Kimberly-Clark before, we already understand their internal documentation and communication structure. That insight helps us anticipate bottlenecks and reduce unnecessary back-and-forth, ensuring your transfer progresses smoothly and without surprises.

How Long Do Kimberly-Clark Pension Transfers Take with Cameron James?

We believe Cameron James is among the fastest firms in the UK when it comes to Defined Benefit (DB) and Defined Contribution (DC) pension transfers, and our experience with the Kimberly-Clark scheme supports that claim.

From our own internal records and feedback from administrators, we've consistently received praise for the accuracy and completeness of our documentation. Our team handles a high volume of transfers every week, so we’re highly familiar with the Kimberly-Clark forms, procedures, and likely follow-up requests.

In the real-life case study mentioned earlier, we completed a Kimberly-Clark DB pension transfer in just over 7 months, a timeline that would likely have stretched to 12 months or more without our streamlined processes.

Our internal structure also contributes to our efficiency: instead of a single person handling everything, we operate in specialised teams, IFAs, compliance, paraplanning, and transfers, each focused on their area of expertise. This ensures accuracy and speed at every stage of your transfer.

⚠️ Important: While we manage the transfer process and liaise directly with Kimberly-Clark on your behalf, all DB transfer suitability advice is conducted independently by an FCA-regulated Pension Transfer Specialist in line with UK regulatory requirements.

Why Doesn’t a Kimberly-Clark DB Transfer Happen in Days?

Seven months might sound like a long time, but with Defined Benefit pension transfers, especially those over £30,000, every step is subject to strict Financial Conduct Authority (FCA) regulation to protect you from poor decisions and pension scams.

Under UK law, no DB transfer can proceed until a regulated 3rd Party Pension Transfer Specialist has assessed your full financial picture, completed a formal suitability analysis, and issued a written report confirming whether transferring out is in your best interest.

While this may feel slow, it’s there for a reason: to protect you from unknowingly giving up guaranteed lifetime income, inflation protection, and valuable dependent benefits. Cases like the British Steel Pension Scheme scandal show the real risks of misadvised transfers, where members lost their guaranteed income, and advisers collected substantial commissions (Reuters, 2023).

At Cameron James, we take a cooperative approach. We work with Kimberly-Clark, not against them, submitting structured, accurate, and regulator-compliant transfer packs that match their internal processes and reduce delays.

Think of it like submitting a university assignment, two students may have the same facts, but the one who presents their case clearly and logically gets the higher grade. Likewise, our well-prepared transfer documentation improves your chances of a faster approval.

With over a decade of experience and direct insight from our CEO and Transfer Team, we know how and when to present the right information to Kimberly-Clark, helping you get the clarity and control you need over your pension.