Background

The Shell Contributory Pension Fund (SCPF) is a long-standing Defined Benefit (DB) pension scheme for Shell UK employees, officially established on 17 December 1938. Celebrating over 85 years of operation, the SCPF is overseen by Shell Pensions Trust Limited, which serves as the Trustee and ensures the scheme is run in accordance with its Trust Deed, governing regulations, and broader UK pension legislation.

The scheme no longer admits new entrants, as the Defined Benefit section stopped accepting new members around 2014. Members who leave Shell or opt out of the scheme cannot rejoin. Today, the Trustee divides the SCPF into two sections, the Pre-2009 Section and the Post-2009 Section, each offering slightly different benefit entitlements.

To maintain transparency and keep members informed, the Trustee Board publishes an annual newsletter, The Source, outlining scheme updates and financial performance. In 2024, Shell Pensions Trust Limited appointed Alan McLean a Chair, bringing leadership continuity to the scheme's governance.

The closure of the DB section reflects a broader trend seen across UK pensions in recent decades. Many employers have shifted away from Defined Benefit plans due to their long-term cost and funding risks, favouring Defined Contribution arrangements that transfer investment responsibility and risk to employees.

CEO Summary:

“The Shell Contributory Pension Fund (SCPF) is a rare example of a well-managed, fully funded Defined Benefit (DB) scheme in today’s retirement landscape. With an actuarial funding level of 108% as of December 2023, SCPF stands as one of the more secure DB schemes we’ve reviewed, particularly given its commitment to liability matching, long-term de-risking, and transparent communication with members.

At Cameron James, we’ve supported multiple clients through the complexities of SCPF transfers. The scheme’s administrative performance is above average, calls are answered promptly, documentation is well-structured, and key scheme data is clear. However, despite its financial health and administrative efficiency, SCPF is still subject to the same regulatory and suitability requirements that govern all DB schemes over £30,000. This means a regulated third-party pension transfer specialist must provide formal suitability advice before any transfer can proceed.

Transferring out of a final salary scheme like SCPF is not a decision to take lightly. While it offers strong inflation protection (with RPI-linked increases up to 7%), generous spouse and dependent benefits, and long-term income security, it may not suit every individual’s needs, particularly those seeking greater flexibility, early access, or estate planning advantages.

If you're a current or former Shell employee weighing up your options, my recommendation is simple: get clarity early. Whether you stay or transfer, being proactive ensures you're not left making rushed decisions as retirement nears. Book a consultation with our team, our experience with SCPF cases means you’ll receive practical, scheme-specific advice grounded in real client outcomes.”

— Dominic James Murray, CEO & Founder of Cameron James

Funding Levels of the Shell Contributory Pension Fund (SCPF): Navigating Market Fluctuations and Long-Term Stability

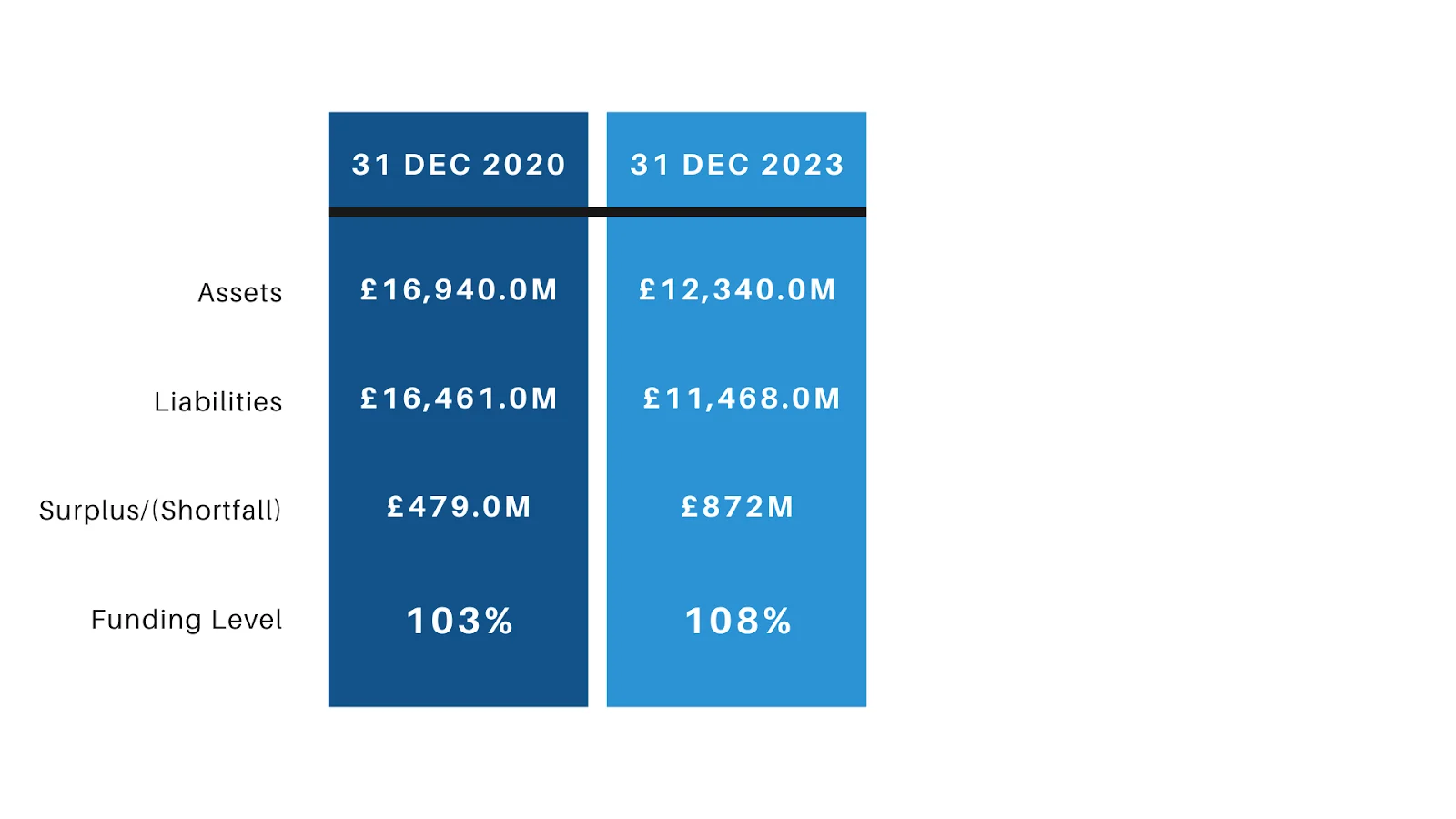

The financial strength of a pension scheme is a key concern for its members, and the funding level, measuring the ratio of assets to liabilities, provides a critical indicator of security. In the case of the Shell Contributory Pension Fund (SCPF), publicly available Summary Funding Statements reveal a well-managed and resilient financial position.

Like many large UK pension schemes, the SCPF undergoes a full actuarial valuation every three years. These valuations offer a comprehensive assessment of the fund’s financial health and help shape its long-term strategy. According to the latest valuation (published in July 2024 and based on data as of 31 December 2023), the SCPF continues to pursue a “de-risking journey” under its broader “Journey Plan 2 (JP2),” with the ultimate goal of achieving full self-sufficiency.

2023 Valuation: Strong and Stable

As of 31 December 2023, the SCPF reported the following:

- Funding Level: 108%

- Status: Fully funded

- Strategy: Reflects a lower-risk investment approach compared to previous years

This 108% funding level indicates that the scheme holds more assets than needed to meet its current obligations, a positive sign for member security, especially given the more conservative portfolio positioning.

2022 Estimate: Higher, But Misleading

In contrast, the estimated funding level as of 31 December 2022 was 123%. However, this figure was influenced by asset reallocation decisions that were not fully incorporated into the liability assumptions at the time. The subsequent decrease to 108% in 2023 reflects the implementation of these investment de-risking actions rather than any deterioration in the scheme's underlying health.

Throughout these fluctuations, the Trustee’s core mission remains unchanged: to ensure all benefits are paid in full and on time. Importantly, Shell has not withdrawn any funds from the scheme, and the robust funding position continues to offer reassurance to members about the long-term stability of their pension entitlements.

Source: Shell Pensions Trust Limited, The Source Newsletter, available at: scpfsource.com (Accessed: 8 July 2025)

What Does Being In Pension Deficit Mean? How Might It Affect You?

When a Defined Benefit pension scheme like the Shell Contributory Pension Fund (SCPF) enters a deficit, it simply means that the scheme’s current assets are not sufficient to cover the total estimated cost of the future pensions it has promised to pay its members. In other words, the liabilities exceed the assets, creating a shortfall.

The Trustees of the scheme are legally obligated to report any funding deficit to The Pensions Regulator (TPR). In response, they must submit a Recovery Plan, which outlines how they intend to close the funding gap over a set period, typically with the support of additional employer contributions and a revised investment strategy.

While having a Recovery Plan in place is an important first step, it demonstrates recognition of the issue and intent to resolve it, it’s important to understand that there is no legal guarantee the Recovery Plan will be successfully completed. If progress stalls or targets are not met, the Trustees are simply required to submit a revised plan to the regulator.

This lack of strict enforcement doesn't necessarily mean your pension is at risk. Many schemes experience temporary deficits, especially during periods of market volatility or changes in interest rates. However, persistent underfunding combined with employer distress can lead to more serious concerns, such as benefit cuts or eventual entry into the Pension Protection Fund (PPF). For now, SCPF remains well-funded, and current figures indicate strong governance and oversight.

Still, it’s wise to stay informed. If you're considering a transfer or want to understand the security of your benefits in light of any funding position, it’s worth speaking with a regulated pension adviser who can assess your specific circumstances.

How Is Your Money Invested? (SCPF)

The Shell Contributory Pension Fund (SCPF) follows a carefully structured investment strategy designed to achieve long-term growth while managing risk, ensuring the Fund can meet its pension obligations to members now and into the future. Oversight of these investments lies with the Trustee Board, which is legally bound to act in the best interests of all scheme members.

Diversified and Balanced Investment Strategy

The SCPF employs a diversified investment approach, combining growth-seeking assets with more stable, defensive holdings. This balance supports both the short-term resilience and long-term sustainability of the scheme. The Fund’s asset allocation is reviewed regularly and guided by its formal Investment Policy and Principles, which reflect changes in market conditions, economic outlook, and funding targets.

Growth-Seeking Assets

These assets are intended to drive long-term capital appreciation:

- Equities – Investments in company shares across developed and emerging markets to participate in global economic growth.

- Alternatives – Including:

- Property – Direct investment in commercial real estate.

- Private Equity – Investment in non-public companies, often with higher return potential but increased risk.

- Other Alternatives – Such as infrastructure and hedge funds, providing diversification and uncorrelated returns.

- Property – Direct investment in commercial real estate.

Stability-Oriented Assets

To reduce risk and enhance portfolio resilience, the SCPF also allocates capital to more stable investment instruments:

- Bonds – Fixed-income securities issued by governments and corporations, providing predictable returns and downside protection.

Investment Governance and Risk Oversight

The Trustee Board governs the Fund’s investment activities based on several core principles:

- Investment Policy and Principles – The cornerstone document defining objectives, acceptable risk levels, and responsible investment guidelines.

- Diversification – Reducing concentration risk by spreading assets across asset classes, industries, and geographies.

- Risk Management – Ongoing monitoring of performance and adherence to the Fund’s risk tolerance framework.

- Responsible Investment – ESG (Environmental, Social, Governance) considerations are increasingly integrated into decision-making, reflecting the Fund’s commitment to sustainability.

Liability Driven Investments (LDI): Managing Risk with Precision

One of the most important tools used by the SCPF, like many Defined Benefit schemes, is Liability Driven Investment (LDI). This strategy aims to align the movement of the scheme’s assets with its liabilities, particularly in response to changes in interest rates and inflation.

Why LDI Matters

The value of future pension payments (liabilities) is sensitive to market shifts, especially falling interest rates, which can significantly increase the present value of those liabilities. LDI seeks to reduce this mismatch.

How It Works

LDI strategies typically involve using derivatives, such as interest rate and inflation swaps, to ensure that the value of the Fund’s assets reacts in a similar way to its liabilities when market conditions change.

The Outcome

By dampening volatility in the scheme’s funding level, LDI brings greater stability and helps ensure members’ pensions remain secure, even during times of economic stress.

If you're unfamiliar with how LDI works in practice, or want to understand how market events like the Kwasi Kwarteng mini-budget affected DB schemes using LDI, you can watch our explainer video on our YouTube channel:

Note: While LDI is a core component of SCPF’s investment strategy, the specific methods and instruments used may vary over time based on Trustee discretion, market conditions, and actuarial input.

Facts About the Shell Contributory Pension Fund (SCPF) Defined Benefit Scheme

Below are the key features and entitlements associated with the Shell Contributory Pension Fund (SCPF), based on typical data collected from a Cash Equivalent Transfer Value (CETV) and Purely Pension Form. These are important considerations when evaluating the value of staying in the scheme versus transferring out.

| Feature | Staying in SCPF DB | Transfer Out |

|---|---|---|

| Indexation in Retirement | Linked to RPI: up to 7% (Pre-2009), 5% (Post-2009) | No guaranteed increases; depends on investment performance |

| Spouse Pension | Payable to a Qualifying Spouse | May depend on drawdown strategy; fully flexible |

| Children's Pension | Payable to dependent children under 18, or under 23 if in full-time education | Inheritance planning flexible; depends on drawdown setup |

| Early Retirement Age | From NMPA (currently 55; rising to 57 in 2028) | Can access from NMPA; greater withdrawal flexibility |

| Late Retirement Option | Continue working and building pension, or draw while working | Full investment control; draw when preferred |

| Tax-Free Cash (PCLS) | 25% x pension x commutation factor | 25% of fund value (standard UK rules) |

| Early Retirement Reduction | 3.5% per year before NPA | No scheme-based reduction; market volatility risk |

| Normal Pension Age (NPA) | 60 (Pre-2009), 65 (Post-2009) | No fixed NPA; drawdown flexible after 55 |

| Increases in Deferment | RPI-linked, capped at 7% (Pre-2009), 5% (post-2009) | Not guaranteed; based on performance |

Retail Price Index (RPI) or Consumer Prices Index (CPI)

The SCPF uses the Retail Price Index (RPI), not CPI, as the basis for annual pension increases. This offers stronger inflation protection for most members, especially those in the Pre-2009 section.

Pension Increase Caps (Shell, 2024)

- Pre-2009 Section: Max increase 7% annually

- Post-2009 Section: Max increase 5% annually

Annual Increases (Past 6 Years):

- 2023: 7.0%

- 2022: 7.0%

- 2021: 1.2%

- 2020: 2.2%

- 2019: 2.7%

- 2018: 4.1%

Spouse’s and Children’s Benefits in Detail (SCPF)

Spouse’s Pension

- Eligibility: Legal spouse or civil partner

- Amount: Typically 60% of member’s pension, calculated pre-commutation or early retirement reduction

- Start Date: Begins the month after the member’s death

- Increases: Indexed annually in line with RPI, subject to scheme caps

Children’s Pension

- Eligibility:

- Under 18 (standard)

- Under 23 (if in full-time education)

- No age cap if dependent due to disability

- Under 18 (standard)

- Amount: Based on number of eligible children and whether a spouse also survives

- Consideration: More children or absence of a spouse results in higher proportional benefit per child

Death in Service

- If the member dies while employed, a discretionary lump sum may be paid by the Employing Company.

Early & Late Retirement (SCPF)

Normal Retirement Age

- Pre-2009 Section: 60

- Post-2009 Section: 65

- Note: Some exceptions apply for members with specific historical service (e.g. Fleet, Aircrew, Overseas B before 1986)

Early Retirement

- Eligibility: Typically available from NMPA (currently 55)

- Reduction Factor: 3.5% per year before NPA

- Set By: Founding Companies in consultation with the Scheme Actuary

- Example: Retiring 5 years early (at 60 instead of 65) results in a 17.5% pension reduction

Late Retirement

- Options:

- Continue working and accruing benefits

- Stop contributing but begin pension income

- Continue working and accruing benefits

- Increase Factor: Not detailed in the scheme booklet

- Maximum Age: Not explicitly stated in public materials

Important Considerations

- Early and late retirement terms are scheme-specific and governed by the Trust Deed & Regulations

- Reduction factors are based on actuarial projections and are subject to change

- Always request formal illustrations when considering early or late retirement

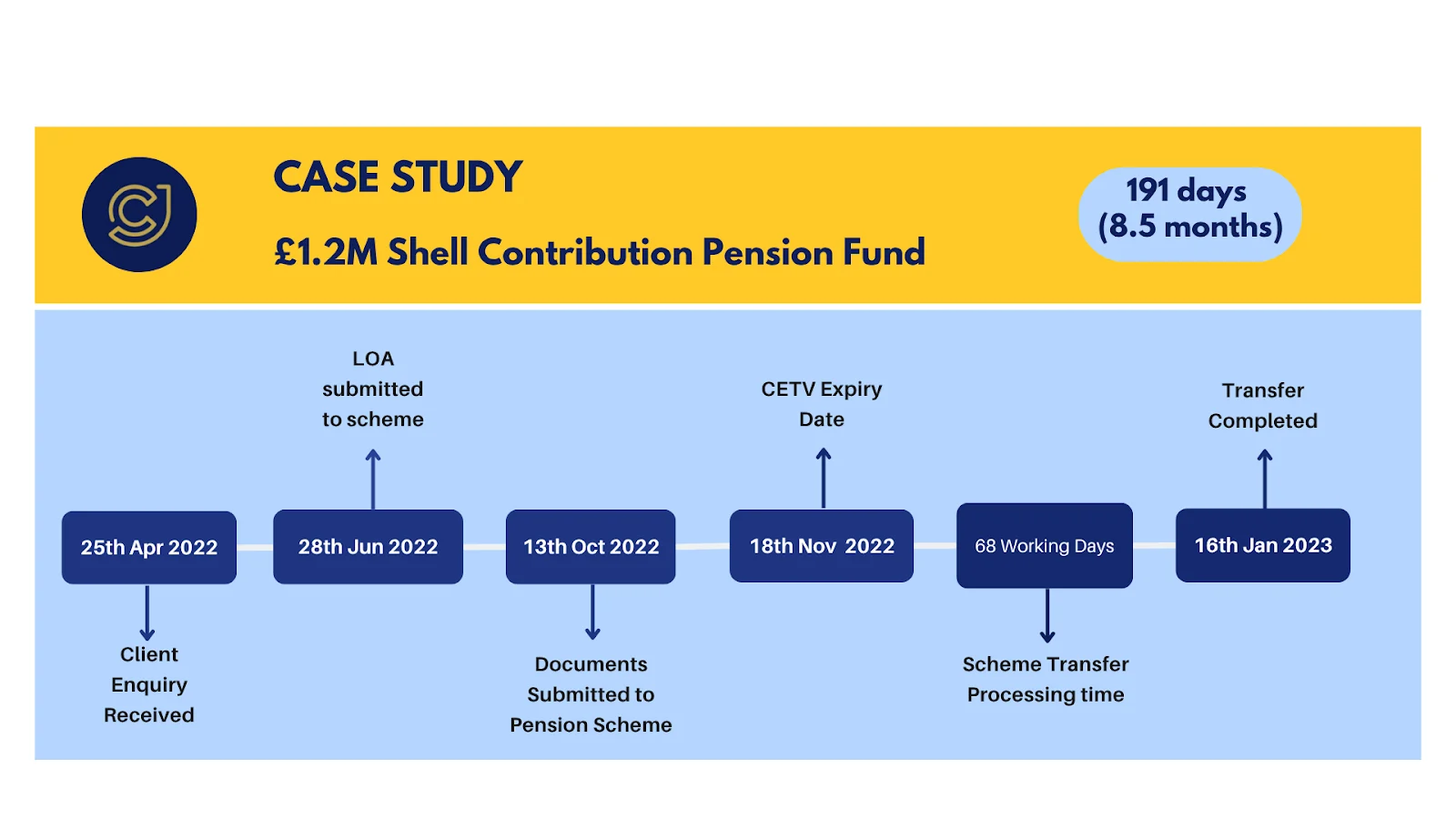

Recent Case Study: Transferring Out of SCPF

| Field | Value |

|---|---|

| Client | Mr. Davies |

| Initial Enquiry Date | 25 April 2022 |

| LOA Submitted | 28 June 2022 |

| CETV Value | £1,249,149.62 |

| CETV Expiry | 18 November 2022 |

| Scheme Processing Time | 68 working days |

| Final Transfer Date | 16 January 2023 |

| Total Timeline | 145 working days |

Documents Submitted:

- AML/KYC

- DBAR – FAD

- Transfer Out Forms: 10 November 2022

- Receiving Scheme Declaration: 9 November 2022

- Client Questionnaire: 17 November 2022

- MH Unique Ref: 20 December 2022

This case highlights the importance of starting early and ensuring documents are submitted promptly. While some transfers can take less time, Defined Benefit schemes like SCPF often involve multiple stages, including actuarial review, documentation checks, and external compliance processes.

Our Transfer Team Verdict on the Shell Contributory Pension Fund Scheme: 7/10

In our experience, the Shell Contributory Pension Fund (SCPF) stands above average in terms of administrator responsiveness and documentation quality.

- Phone Support: Calls are typically answered within 10 to 15 minutes, substantially better than many UK pension schemes, where we sometimes face wait times exceeding 60 minutes. For best results, we recommend calling during UK morning hours, as phone lines tend to become congested later in the day.

- Email Response Time: Emails are generally answered within five working days, which is again well above industry norms. This helps reduce delays in transfer coordination and keeps the process moving forward.

- Case Handling: In the case referenced earlier, the SCPF assigned specific administrators to oversee the transfer. This continuity meant we dealt with the same personnel throughout, allowing for consistent communication and a smoother experience.

- Quality of Scheme Information: The documents received from SCPF were clear, structured, and covered all key data points, something we greatly value. Well-prepared scheme information reduces the need for repeated follow-ups, allowing us to compile a complete CETV pack and submit it to the Pension Transfer Specialist efficiently.

This ultimately speeds up the delivery of regulated advice and helps clients receive their recommendations without unnecessary delay. While there’s always room for improvement, SCPF compares favourably to many Defined Benefit schemes we encounter.

Ready to Understand Your SCPF Options?

Whether you're considering transferring out or simply want a clearer understanding of your Shell Contributory Pension, seeking advice early can help you avoid unnecessary delays, understand your entitlements, and make informed, confident decisions about your retirement.

Speak with a UK-regulated adviser who has direct experience handling SCPF cases and can guide you step-by-step through the process.

Want to Learn More About SCPF?

If you're looking to deepen your understanding of the Shell Contributory Pension Fund (SCPF), we invite you to explore our educational videos on the Cameron James YouTube channel:

- How To Transfer Your Shell Pension (Shell Overseas Contributory Pension Fund /SOCPF) | Cameron James

- Shell Overseas Contributory Pension Fund (SOCPF) – What Happens If I Die?

- Shell Final Salary Pension Closed Overseas Plan SOCPF – What Shell Employees Should Know! 🛢️

- Shell Bermuda Overseas Contributory Pension Fund (SOCPF) – CETV & Opting-Out? 🇧🇲

We have extensive experience with the SCPF and it has been covered in detail by our CEO on multiple occasions to help members like you make informed decisions about their financial future.

FAQ

- How Will Cameron James Keep My Pension Transfer on Track?

At Cameron James, your pension transfer is actively monitored by our dedicated Transfer Team, a specialist department focused solely on progressing client transfers efficiently and accurately.

Once your paperwork is submitted, the team will contact your pension scheme every 3–5 working days to check on progress and ensure timelines are being followed. You’ll receive bi-weekly updates, so you're always informed about where things stand.

The team operates Monday to Friday, 8am–5pm, speaking daily with schemes across the UK to move transfers forward. They know the service standards pension schemes commit to, and they’ll hold them accountable. If your scheme falls behind or causes undue delays, the Transfer Team will escalate the matter directly and, where appropriate, submit a formal complaint on your behalf if compensation may be due.

With years of experience handling transfers from all major schemes, they know how to navigate delays, flag bottlenecks early, and ensure your case doesn’t sit idle. It’s all part of making the process as smooth and stress-free as possible for you.

- How Long Do Cameron James Pension Transfers Take?

At Cameron James, we believe we are among the fastest firms in the industry when it comes to processing Defined Benefit (DB) and Defined Contribution (DC) pension transfers.

We know this not just from our own experience, but also from direct feedback from scheme administrators, including DB ceding schemes who frequently comment on the speed and accuracy of our paperwork.

One of the key reasons for this is the high volume of transfers we manage each week. Our team is highly familiar with the detailed, and often complex, forms required for transfers. In many cases, we already know which documents or additional questionnaires your scheme will request before they’ve even been issued, allowing us to act quickly and avoid unnecessary delays.

We also operate with a specialist departmental structure. Each internal team, from our IFA team and support staff to compliance and transfers, focuses on their specific area of the process. This approach ensures efficiency, accuracy, and accountability, rather than overloading any single adviser or administrator.

In the example covered earlier, a transfer that took just over 7 months would likely have taken 12 months or more without our experience and coordination. In more challenging scenarios,as we’ve seen from clients who came to us after failed attempts with other firms, delays or errors can result in blocked transfers or expired CETVs, where the entire process must be restarted from scratch.

Important Note: While Cameron James manages the entire transfer process and liaises directly with your pension scheme, all Defined Benefit transfer suitability advice is carried out by an independent FCA-regulated Pension Transfer Specialist, in line with regulatory requirements.

- Why Doesn’t a DB Transfer Happen in Days?

A pension transfer timeline of seven months may sound lengthy at first. However, it reflects the level of strict regulation imposed by the Financial Conduct Authority (FCA) to protect members with Defined Benefit pensions over £30,000.

Under current rules, any DB transfer must go through a regulated and independent advice process, carried out by a 3rd Party FCA-Regulated Pension Transfer Specialist. This process includes collecting scheme data, assessing personal financial circumstances, identifying any amber or red flags, and issuing a full Suitability Report before a transfer can legally proceed.

While this process can feel slow or frustrating, it exists to protect members from both financial harm and misinformed decision-making. Whether it’s unknowingly giving up a guaranteed income for life or falling prey to poor advice or scams, the regulation is designed to ensure clients fully understand their options before proceeding.

A widely known example is the British Steel Pension Scheme scandal, where hundreds of steelworkers were advised to transfer out of their defined benefit scheme without understanding the consequences. Many lost the security of their guaranteed income, while advisers received substantial commissions for the advice they gave (Reuters, 2023).

At Cameron James, we recognise that the Shell Overseas Contributory Pension Fund (SOCPF) trustees and administrators have a legal responsibility to protect members and verify that every transfer is properly advised. Our approach is to work with the scheme, not against it: submitting structured, accurate, and complete documentation that aligns with their internal checks and reduces the time needed for approval.

We often compare it to writing a university exam: even if two answers contain the same information, the one that's clearly written and easy to follow will receive a higher mark. Similarly, a well-presented transfer pack helps administrators approve your transfer faster.

With over a decade of experience, including direct insight from our CEO, we understand how to present, when to present, and what to prioritise when dealing with Defined Benefit ceding schemes like SOCPF. This experience helps to reduce unnecessary back-and-forth and supports a smoother, more efficient transfer, should you decide to proceed following your formal Suitability Report.